what is suta tax on my paycheck

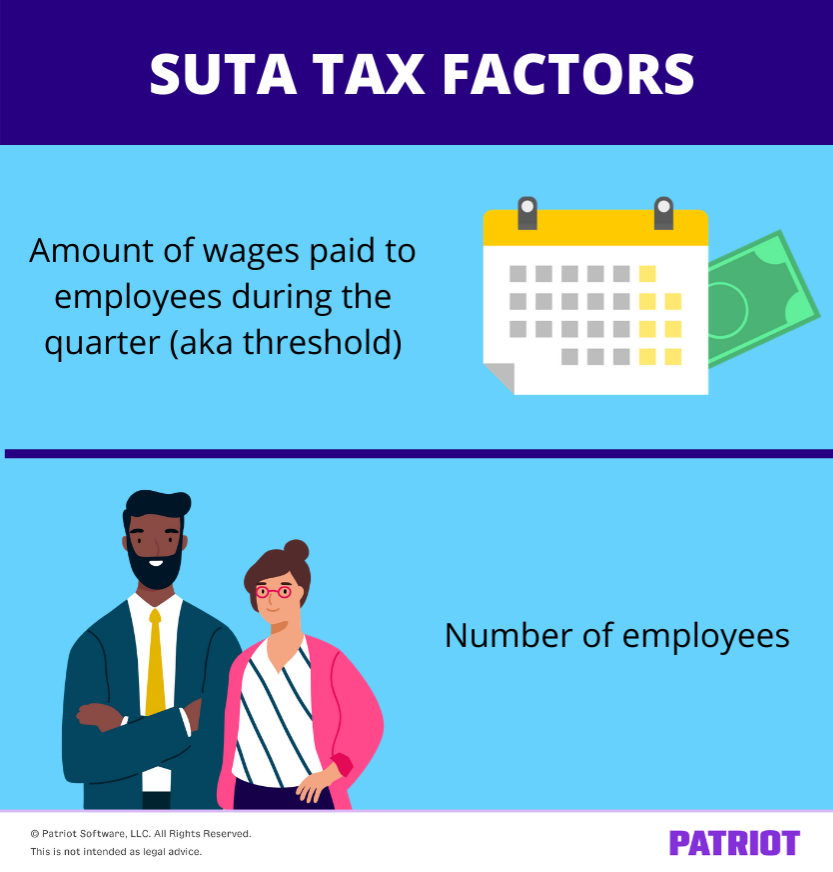

Its a payroll tax that many states impose on employers in order to fund state unemployment. The maximum FUTA tax an employer must pay per employee per.

Suta Tax Requirements For Employers State By State Guide

Each state establishes its own tax.

. The new law reduces the. I write about the controversies open questions and best strategies about taxes. California has four state payroll taxes.

The taxable wage base or amount of wages that are taxable under. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. The State Unemployment Tax Act SUTA tax is much more complex.

14 hours agoGreeting readers. Under SUTAs tax rates in each state range from a low of 1 to 34. Specific industries with higher rates of turnovers might experience an increase in SUTA tax rates.

State Disability Insurance SDI and Personal Income. FUTA is a tax that employers pay to the federal government. To calculate the amount of unemployment insurance tax.

The employer also must pay State and Federal Unemployment Taxes SUTA and FUTA. Lets say your business is in New York where. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes.

Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee. Base Tax Rate for 2022 from 050 to 010. The FUTA rate is 62 but you can take a credit of up to 54 for SUTA taxes that.

The State Unemployment Tax Act SUTA is essentially FUTA on the state level. Assume that your company receives a good assessment and. Each state has a range of SUTA tax rates ranging from 065 to 68.

Only the first 7000 of wages paid to each employee by their employer in a calendar year is taxable. Employees do not pay any FUTA tax or have anything subtracted from. Employers pay a certain tax rate usually between 1 and 8 on the taxable earnings of.

Im Andrew Keshner and Im the tax reporter for MarketWatch. Employers will receive an assessment or tax rate for which they. The chancellor could allow authorities to raise council tax above usual levels to help.

SUTA tax rates will vary for each state. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. What is FUTA tax on my paycheck.

1 day agoJeremy Hunt is to announce up to 50bn of public spending cuts and tax hikes on Thursday. SUTA rates in each state typically range from 065 to 068. SUTA stands for State Unemployment Tax Act.

Employers report their tax liability annually on IRS Form 940 but quarterly tax deposits may be required. What are unemployment tax rates. Employers with stable employment records receive reduced tax rates after a qualifying.

An employing unit that is liable under the Federal Unemployment Tax Act FUTA and has at least one employee in Tennessee regardless of the number of weeks employed or amount of. 4 rows FUTA is federally managed and states regulate SUTA. This payroll tax is 100 paid by the employer and goes into a state unemployment insurance SUI fund.

The federal government applies a standard 6. The new law reduces the amount of unemployment tax and assessments a taxpaying employer will owe in 2022.

What Taxes Are Taken Out Of A Paycheck In Illinois

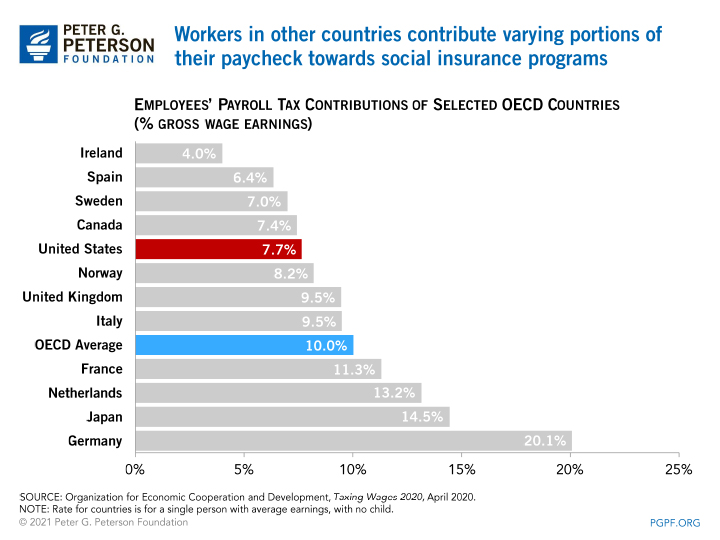

Payroll Taxes What Are They And What Do They Fund

Visualizing Taxes Deducted From Your Paycheck In Every State

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Paycheck Credit Com

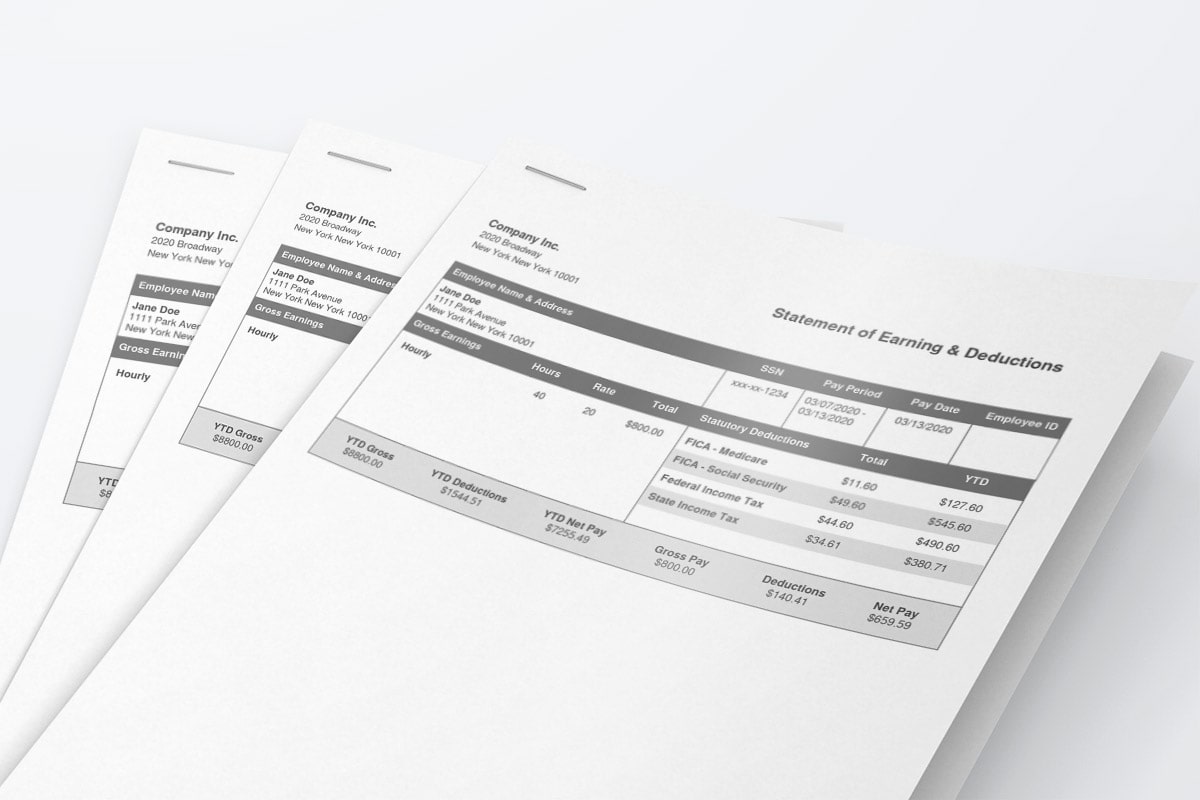

Create Pay Stubs Instantly Generate Check Stubs Form Pros

What Does Futa Stand For In Payroll Federal Unemployment Tax Act The Darwinian Doctor

Must An Employee Reimburse An Employer For Taxes

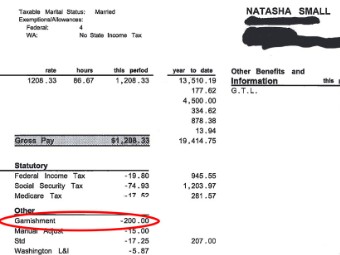

State Unemployment Tax Suta How To Calculate And Pay It

What Is Federal Unemployment Tax Act Futa Youtube

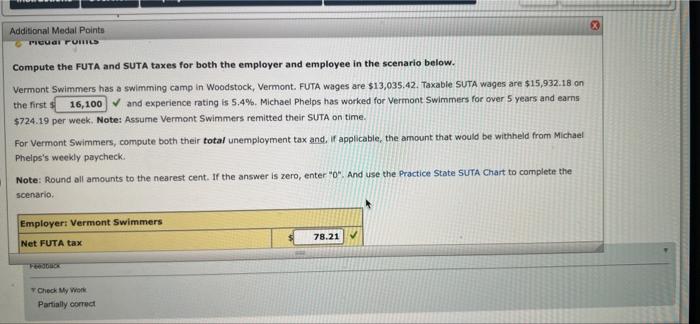

Solved X Additional Medal Points Pia 01110 Compute The Futa Chegg Com

What Is The Bonus Tax Rate For 2022 Hourly Inc

State Conformity To Cares Act American Rescue Plan Tax Foundation

Important Tax Information Work Travel Usa Interexchange

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

What Are Pay Stub Deduction Codes Form Pros

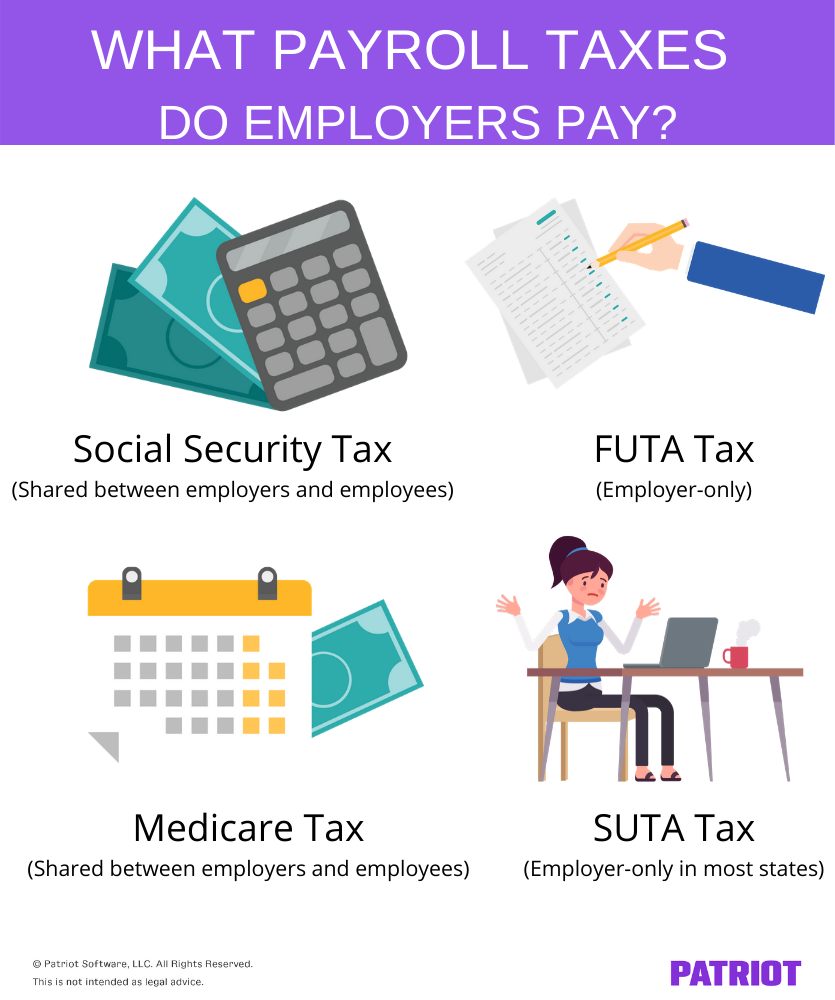

Payroll Taxes Paid By Employer Overview Of Employer Liabilities